Welcome to Emerald Close Consultancy

Your Trusted Accounting & Tax Partner

Bookkeeping

Tax Consultancy

Compliance

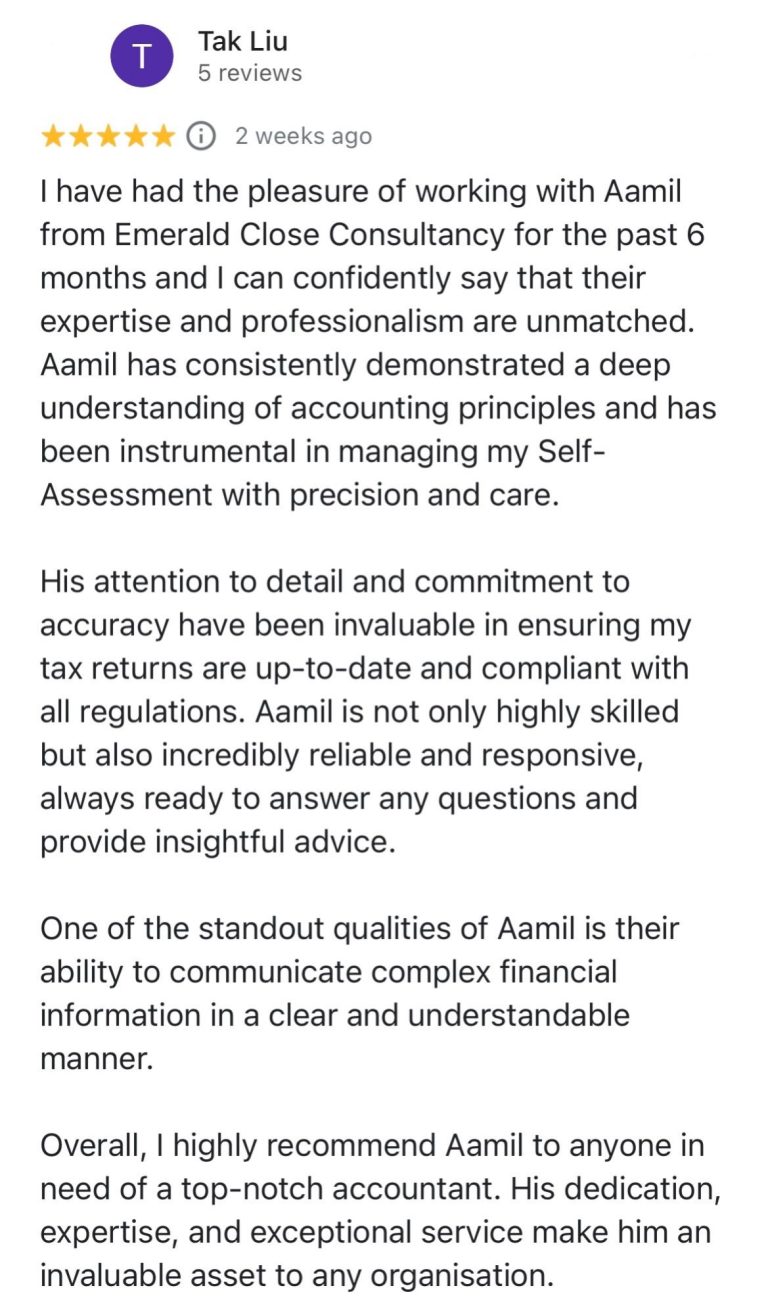

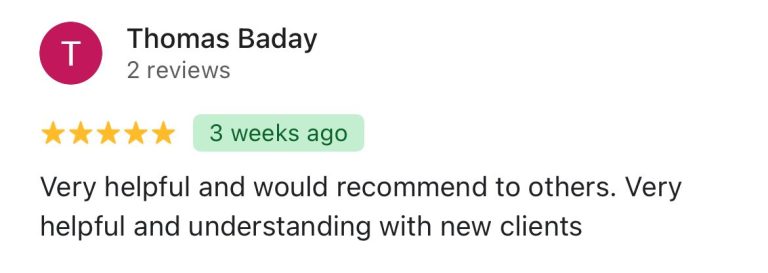

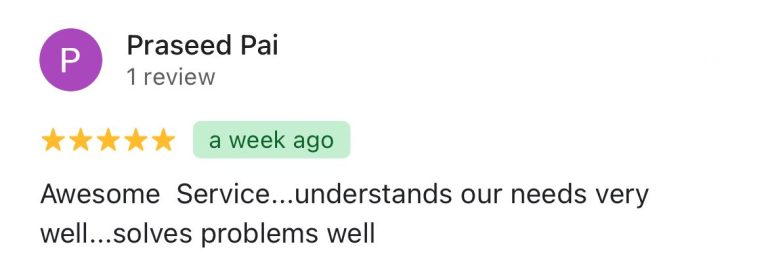

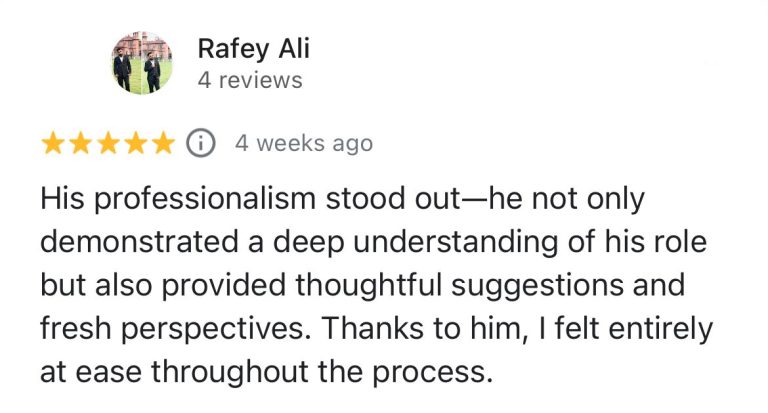

Client Feedback

Our promise

Quality Service

Expert Consulting

Useful links for Self Employed Individuals

At Emerald Close Consultancy, we’re committed to providing useful resources to help self-employed individuals navigate the UK tax system. Our goal is to simplify the process, helping you save time, reduce stress, and ensure compliance with HMRC requirements. The following content is produced by HM Revenue & Customs (HMRC) and is embedded here for informational purposes only. Emerald Close Consultancy is an independent accountancy firm and is not affiliated with or endorsed by HMRC.

How to register for Self Assessment?

In this video, you'll learn the step-by-step process for registering for Self Assessment with HMRC, ensuring you're set up correctly to report your income and meet your tax obligations.

Self Assessment Penalties

We aim to keep you informed about the potential consequences of missing tax deadlines. This video outlines the penalties for late Self Assessment filing and payment, helping you stay aware of important deadlines and avoid unnecessary costs.

How can i appeal a late filing penalty?

At Emerald Close Consultancy, we understand that unexpected circumstances can sometimes lead to late filing of tax returns. This video provides a step-by-step guide on how to appeal a late filing penalty with HMRC, including the valid reasons for an appeal and how to submit your request effectively.

Contact us

Telephone: +447424666882

E-mail: aamir@ecconsultancy.co.uk

Address: 30 Churchill Place, London, E14 5RE

We would love to hear from you-whether you have a question, need support, or simply want to connect, we are here to help.